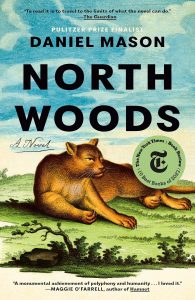

On Tuesday, July 15, at 1pm, the Free Library of New Hope and Solebury is hosting a book discussion of North Woods by Daniel Mason. All are welcome to attend! If you’re unable to make it in person, but would like to attend virtually, please email jacobsone@buckslib.org.

Book Chat meets two Tuesdays a month at the NH-S Library. On the first Tuesday of every month, participants share what they’ve been reading and swap ideas for future reads. On the third Tuesday of every month, a pre-chosen book is discussed.

No registration necessary.